By Jim Caliendo, President & CEO, PWCampbell

Let’s face it, we live in a world where appearance matters. There is nothing more iconic than a look – be it a fashion statement or product packaging, designers spend months, sometimes years refining or creating design schemes with one purpose in mind: to sell you. In this cutthroat environment, every consumer matters. So much so that some big companies are willing to throw hundreds of thousands of dollars into design teams and branding firms to give them the competitive edge. From coffee shops to brand-name retail, CEOs are investing mega-bucks into gaining your business, and every sale counts.

Except for the banking industry. For whatever reason, financial institutions have a habit of being late to adopt the latest and greatest trends. Whether it be jumping on the technology explosion of the 90’s or the branding booms of the 2000’s, financial institutions have continued to remain more status quo, despite an ever-changing environment surrounding them.

BUT WHY?

The reasoning behind the delay to modernize really falls under two different verticals. In one regard, modernization bears risk – something none of us want to take on, especially in these times. Updating your branding, modernizing your branches, and reformatting your services bear a risk that most put off. The conundrum is that this inability to shift with the times may inevitably lead to downfall.

Risk aside, the second vertical focuses on the lack of need to modernize. Since the dawn of time, currency has existed in one form or another. The concept of financial institutions themselves dates at least as far back as the 10th century with the Knights Templar. There has always been a need for institutions to exist, and much like the concept of supply and demand, when demand is high, the scales tip in favor of the suppliers to set the standard. No one cared if branches were outdated, they just cared that they served their purpose. There was a time where the bigger the structure, the more respect it commanded. Gigantic vaults with marble floors, teller lines that spanned for miles; federal architecture was a right-of-passage, and the more columns that were found in front, the more stable and official your institution appeared to be – a true status symbol. Financial institutions had a stronghold on their consumers, and no one, nowhere was going to change that.

Risk aside, the second vertical focuses on the lack of need to modernize. Since the dawn of time, currency has existed in one form or another. The concept of financial institutions themselves dates at least as far back as the 10th century with the Knights Templar. There has always been a need for institutions to exist, and much like the concept of supply and demand, when demand is high, the scales tip in favor of the suppliers to set the standard. No one cared if branches were outdated, they just cared that they served their purpose. There was a time where the bigger the structure, the more respect it commanded. Gigantic vaults with marble floors, teller lines that spanned for miles; federal architecture was a right-of-passage, and the more columns that were found in front, the more stable and official your institution appeared to be – a true status symbol. Financial institutions had a stronghold on their consumers, and no one, nowhere was going to change that.

Cue millennials.

With the influx of millennials spanning over a decade, new business practices began to take shape that further defined how we live and work. The “question everything” generation seemed to flip the world upside-down, leaving their mark on everything that they came across. From standard business practices to work attire, suddenly everything was under a microscope, and nothing seemed sacred. Fast-forward to the growth of Gen-Z, and we find ourselves progressing forward even more so. We are forced to either adapt or be cast aside, made to live out the rest of our days on the Island of Misfit Toys.

AN OBVIOUS SOLUTION

Currency is still king, be it digital, physical, or even crypto. We have heard “branches are going to be dead in 5 years” for the past 20 years, but the reality of the situation is that they are not. Where routine transactions have indefinitely shifted to online, statistics show consumers still overwhelmingly prefer to conduct complex transactions in-branch and in-person. The branch is not disappearing, it is shifting to cater to a new type of consumer. The problem is that the current footprint of branches is still representative of the transaction-heavy approach of the past. You cannot expect to draw in new clients if you are unable to cater to their wants and needs as a consumer – and with the overall shift to online banking, finding unique ways to maintain (or dare I say increase) your consumer reach is proving to be vital to the success and longevity of your brand. It is true that branches are currently closing at a record pace, and need to be reimagined to stay relevant. The failure to deliver a modern approach to the outdated branch will inevitably cause the demise of financial institutions around the globe.

So how do we extend the lifeline of our brand and branch? We take a page from the playbook of other industries and apply it like a science to our financial institutions as soon as possible. We stop being stubborn, and we modernize our branches to deliver an experience that the modern consumer craves. But to do that, we need to start thinking outside the box.

WHAT CONSUMERS WANT

Generationally speaking, the modern consumer thrives in unique environments that drive experience. They crave the personal and shy away from cookie cutter. They want to be challenged creatively and mentally and seek out opportunities to expand their minds. As I said, these generations question everything – so why do we not challenge them to question the concept of a branch?

Generationally speaking, the modern consumer thrives in unique environments that drive experience. They crave the personal and shy away from cookie cutter. They want to be challenged creatively and mentally and seek out opportunities to expand their minds. As I said, these generations question everything – so why do we not challenge them to question the concept of a branch?

Start thinking outside the box to deliver a space that draws your consumers in. David Carson, one of the most iconic graphic designers of our time stated “You need someone to pick up your book, to click on your site, to walk across the street and read the fine print. If you’ve done your job as a designer, people will do that.” And the same holds true for our branches. The point is not only to capture the new family that moved into the area and needs a new branch, it’s also to make people want and need to walk through your doors, whether they intended to bank or not.

A SUBCONSCIOUS NEED

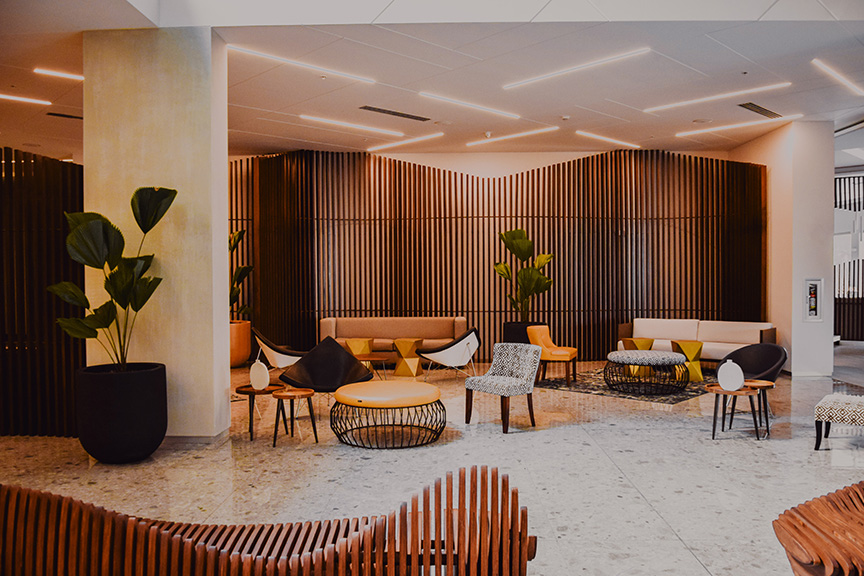

Humans are inquisitive by nature, and we need to use that to our advantage. Architectural elements, art, color, textures; are all things that individually may not seem all that attractive – but put them together and they can be an incredibly powerful tool. When we push the boundaries of design, we entice consumers to be inquisitive. To be honest, a typical financial institution is not all that exciting, and for most consumers, the only time that they would go and visit a branch is if they absolutely need to. That is the perception that needs to change if we want to continue to draw in new consumers to extend the vitality of our brands. We need to do better. Build and design experiences that draw consumers in. Look to upscale night clubs, museums, and modern high end restaurants for inspiration. Luxury hotel lobbies also offer inspirational design for spaces specifically focused to draw people in. There is no rule that states that a financial institution cannot follow high design.

WHERE TO START

If you agree with this approach, then you are on the right track to providing a solid future for your brand and consumers. However you may not know where to start, and that is understandable. Financial people tend to be left-brained, where creativity stems from your right brain. High design may not be your strong suit, and that is okay – it isn’t supposed to be. The simple answer? Outsource. Look for a full-service design-build firm where branding and construction services fall under one roof, allowing you to mitigate costs and streamline the execution. PWCampbell, for example, has been leveraging their in-house design and branding teams to deliver world class branded environments for decades. This allows you to play into our strength of producing a branch that will drive engagement and growth, while offering a state-of-the-art consumer experience – all while you handle the operations of the branch.

Bottom line: If you want to build a better branch, stop building a branch; think outside the box and build something spectacular.

James G. Caliendo is a former bank executive and now President and CEO at the 112 year old design-build and retail services firm. In the past 20 years alone, under Jim’s direction, PWCampbell has worked with over 500 financial institutions influencing millions of square feet of retail and operational space to create engaging, impactful and scalable solutions for every sized facility project.